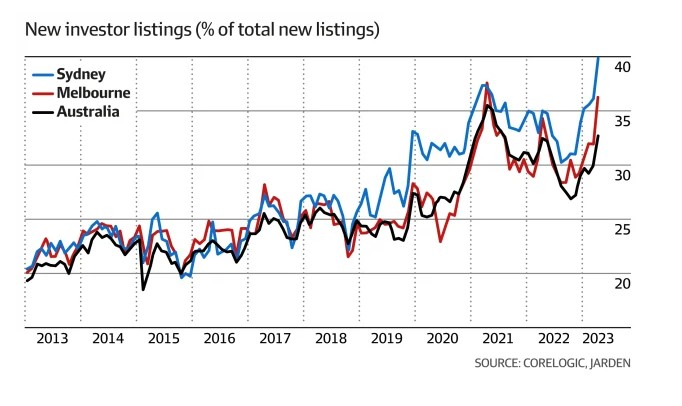

Investors Sell due to cashflow

The number of property investors bailing out of the market is rising as cashflow deficits mount. This is due to a combination of factors, including increases in property taxes, low rental returns relative to values, and massive interest rate increases.

A recent survey found that 27% of investors are considering selling their investment properties. This is up from 18% in the previous quarter.

The survey also found that the main reason for selling is cashflow concerns. Investors are finding it difficult to cover their mortgage repayments and other costs, such as property taxes and maintenance. Rent cap policies of some politicians have also scared landlords into selling as these taxes and holding costs increase.

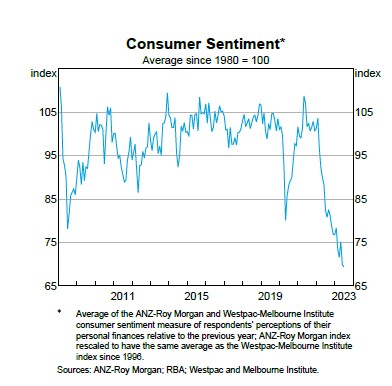

The rising cost of living is also putting pressure on investors’ budgets. With inflation at a 40-year high, many investors are finding it difficult to make ends meet.

The interest rate environment is also making it more difficult for investors to make a profit. The Reserve Bank of Australia has raised the cash rate by 4.00 percentage points since May last year. This has pushed up the cost of borrowing for investors, making it more difficult to generate positive cashflow.

The combination of these factors is making it difficult for investors to make a profit from their investment properties. As a result, many investors are choosing to sell and exit the market.

This is likely to have a significant impact on the property market. With fewer investors buying, (and many selling) there will be less demand for properties. This could lead to a decline in property prices.

It is still too early to say what the long-term impact of this trend will be. However, it is clear that the property market could be facing some headwinds. Investors and home buyers should carefully consider their options before making any decisions about their properties.

With Consumer Sentiment at an all time low compared to the past decade, it is little wonder that investors are cutting losses and selling up.

Recent Comments