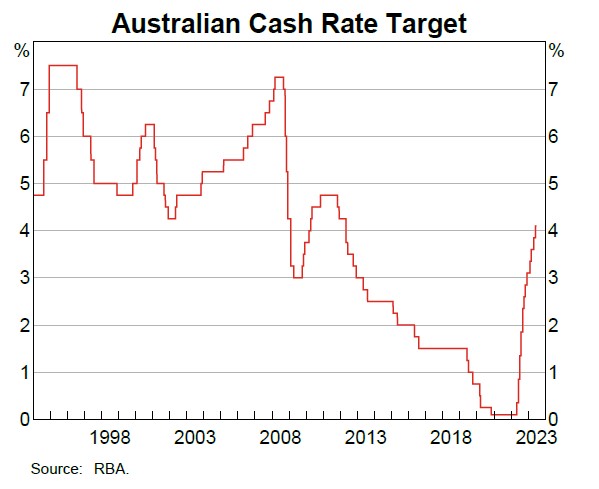

The Australian property market has been witnessing a paradoxical trend where property prices continue to soar despite a series of record interest rate hikes. This unexpected scenario can be attributed to the persistent high demand for properties, fueled by a significant decrease in the number of properties available for sale. In this article, we will delve into the factors contributing to the continuous rise in property prices and the impact of limited supply in Australian capital cities.

High Demand in a Limited Supply Market:

Despite the record number of interest rate increases, the demand for properties in Australian capital cities remains robust. Several factors contribute to this ongoing high demand, ultimately leading to price increases:

- Population growth and urbanization: Australian capital cities continue to attract a growing population due to employment opportunities, lifestyle appeal, and access to amenities. The influx of people into cities creates a sustained demand for housing, even in the face of rising interest rates.

- Limited supply of properties: Over the past years, there has been a significant reduction in the number of properties available for sale in Australian capital cities. Reports indicate that the supply of properties on the market is approximately one-third less than normal market conditions. This scarcity of supply intensifies competition among buyers and drives up property prices.

- Investor activity: The property market has long been favored by investors seeking stable returns and capital appreciation. Despite rising interest rates, property investment remains attractive due to the potential for long-term growth and rental income. The persistent interest from investors adds to the overall demand, amplifying the upward pressure on prices.

- Changing housing preferences: The COVID-19 pandemic has reshaped housing preferences, leading to increased demand for certain types of properties. Factors such as remote work arrangements and a desire for more space have fueled demand for larger homes, properties with home offices, and houses in suburban or regional areas. This shift in demand further drives up prices in specific segments of the market.

- Government incentives and initiatives: Various government incentives, such as the First Home Owner Grant and stamp duty exemptions, have encouraged first-time buyers to enter the property market. These initiatives, combined with low interest rates and limited supply, have increased competition among buyers, further inflating prices.

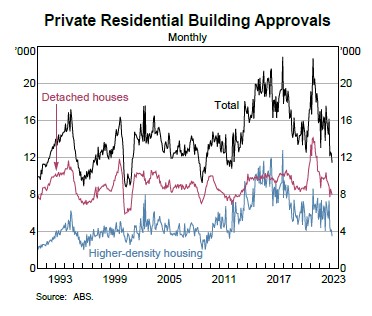

- Limited new construction: The rate of new property construction has not kept pace with the increasing demand. Factors such as zoning restrictions, limited land availability, and construction delays have hampered the supply of newly built properties. The shortfall in construction exacerbates the scarcity of available properties, intensifying competition and contributing to rising prices.

Navigating the Market:

The current landscape poses challenges for homebuyers and investors. However, with careful planning and consideration, it is still possible to make informed decisions:

- Research and due diligence: Conduct thorough research on the local property market, including understanding supply and demand dynamics, price trends, and market forecasts. Stay informed about government policies and initiatives that may impact the market.

- Financial planning: Assess your financial situation and affordability, taking into account rising interest rates and potential changes in borrowing costs. Ensure you have a realistic budget and seek pre-approval for a loan to enhance your bargaining power.

- Property selection: Consider alternative locations or property types that may offer better value for your investment. Look for emerging areas with growth potential or properties that align with changing housing preferences.

- Seek professional advice: Engage with experienced real estate agents, mortgage brokers, and financial advisors who can provide valuable insights and guidance tailored to your specific needs.

Conclusion:

The paradoxical scenario of rising property prices amidst record interest rate hikes in Australian capital cities can be attributed to persistently high demand driven by limited supply. Factors such as population growth, investor activity, changing housing preferences, limited new construction, and government incentives contribute to the ongoing upward pressure on property prices.

For buyer or investor, it is crucial to carefully analyze the market, consider alternative options, and seek professional advice to navigate this challenging environment. Understanding the dynamics of supply and demand and conducting thorough research will help make informed decisions to ensure property investments align with financial goals.

Recent Comments