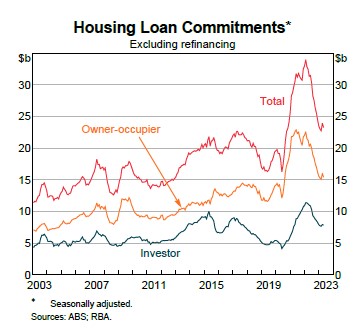

Housing Loan Commitments Rise

After months of decline, housing loan commitments in Australia have finally started to increase. This is due to a number of factors, including optimism in the housing market, interest rates on hold last month, fear of missing out (FOMO), with the rhetoric of increased immigration and lack of house starts.

Optimism in the Housing Market

There is a growing sense of optimism in the housing market, as prices have stabilized and interest rates remain low. This is leading to more people considering buying a property, both for investment and for owner-occupation.

Interest Rates on Hold Last Month

The Reserve Bank of Australia (RBA) held interest rates on hold last month, which was a positive sign for the housing market. This means that mortgage repayments will remain low, which will make it more affordable for people to buy a property.

Fear of Missing Out (FOMO)

Another factor driving the increase in housing loan commitments is fear of missing out (FOMO). With prices starting to rise again, some people are worried that they will miss out on the opportunity to buy a property if they wait too long.

Rhetoric of Increased Immigration and Lack of House Starts

The rhetoric of increased immigration and lack of house starts is also contributing to the increase in housing loan commitments. Some people believe that these factors will lead to a shortage of housing in the future, which will drive up prices.

What Does This Mean for the Housing Market?

It is too early to say what the long-term impact of the increase in housing loan commitments will be. However, it is likely that it will lead to a more buoyant housing market in the coming months.

It is important to note that there are still some headwinds facing the housing market, such as rising interest rates and inflation. However, the combination of optimism, FOMO, and the rhetoric of increased immigration and lack of house starts is likely to keep the market buoyant for the time being.

What Should Buyers and Sellers Do?

If you are a buyer, it is important to be aware of the risks involved in buying a property at this time. Interest rates are expected to continue to rise, which could put pressure on your repayments. Additionally, the market could cool down if there is a change in government policy or if the economy takes a downturn.

If you are a seller, you may be able to get a good price for your property at this time. However, it is important to be realistic about your expectations. The market is not as strong as it was a few years ago, and there is a chance that prices could fall in the future.

Overall, the increase in housing loan commitments is a positive sign for the market. However, there are still some risks involved, and buyers and sellers should be aware of these before making any decisions.

Here are some tips for buyers and sellers:

- Buyers should do their research and be prepared to act quickly if they find a property they want.

- Sellers should price their property competitively and be prepared to negotiate.

- Both buyers and sellers should seek professional advice from a financial advisor or real estate agent.

It is important to remember that the housing market is cyclical, and there will be ups and downs. However, the long-term trend is for prices to rise.

Recent Comments