Sydney is known for its vibrant culture, stunning beaches, and high standard of living. However, it is also well-known for its expensive real estate market. According to recent reports, Sydney rentals have a gross yield of 2.5%, which is not a very attractive return when compared to other investment options, especially considering costs associated with owning investment property and the risks associated with a highly geared , high maintenance investment.

What is Yield and Holding Costs?

Before delving into the specifics, let us first understand what yield and holding costs mean. Yield is the return on investment that a property generates, expressed as a percentage of the property’s value. Holding costs, on the other hand, are the expenses that a property owner incurs while owning and managing a property. This includes property taxes, insurance, maintenance, and management fees.

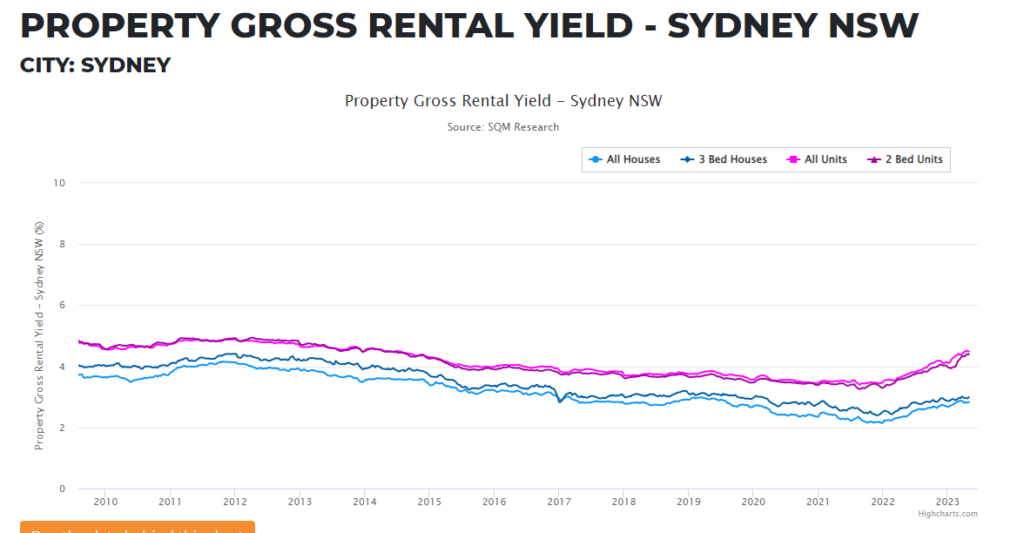

Sydney Rentals Yield

As mentioned earlier, the yield on Sydney rentals is currently around 2.5%. This means that if you were to buy a property in Sydney and rent it out, you would earn a return of 2.5% on your investment minus costs. Property managers costst, rates, land tax , vacancies, strata fees and maintenance can remove all yield even before a mortgage is paid. Without negative gearing, the yield, even without any debt is close to 0%. This is not a very attractive return, especially when compared to other investment options that are available today.

For example, if you were to deposit your money in a risk-free savings account, you could earn a return of around 3.5% or more. This means that you would earn more money by simply keeping your money in a bank than by investing in Sydney rental properties.

If it weren’t for tax incentives and the “Ponzi” scheme of hoping you can sell for a capital gain to some other mug in the future, Sydney property (and the broader Australian residential market) would readjust to international rental yield of closer to 5 – 6 %, potentially cutting valuations by up to 50% in some areas.

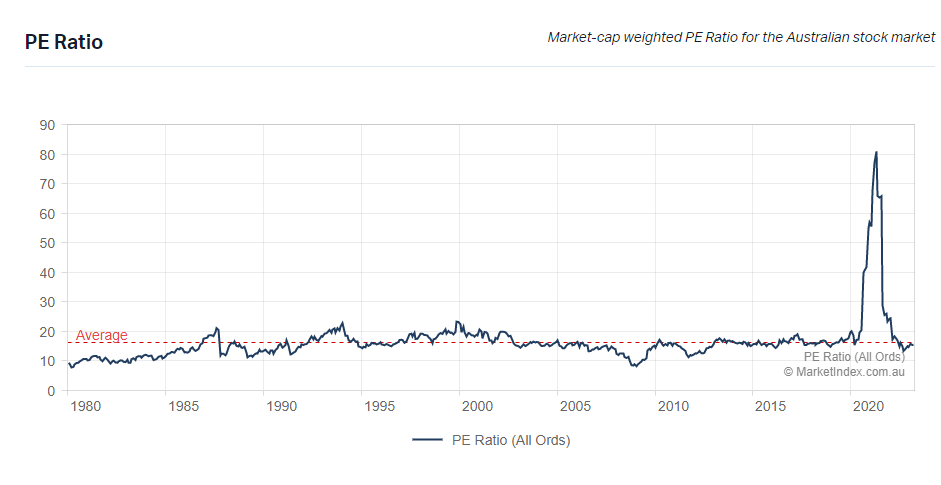

To compare investments, a 2.5% gross yield is similar to a listed company with a price to earnings ratio of 40x. The historical average PE ratio on the ASX is around15x and dividend yield of 4.1% , with franking credits 5.86% with no costs, maintenance or troublesome tenants.

What are your thoughts?

Recent Comments