The Australian property market has been a topic of debate for many years, with many experts weighing in on the various factors that affect it. One of the current debates centers on the impact of low numbers of house starts leading to an undersupply of properties. This, combined with the forecast of high immigration levels, could lead to further increases in property prices. However, the potential impact of higher interest rates on home owners could cause financial hardship, potentially leading to more properties being put up for sale. .

Undersupply of Properties and High Immigration

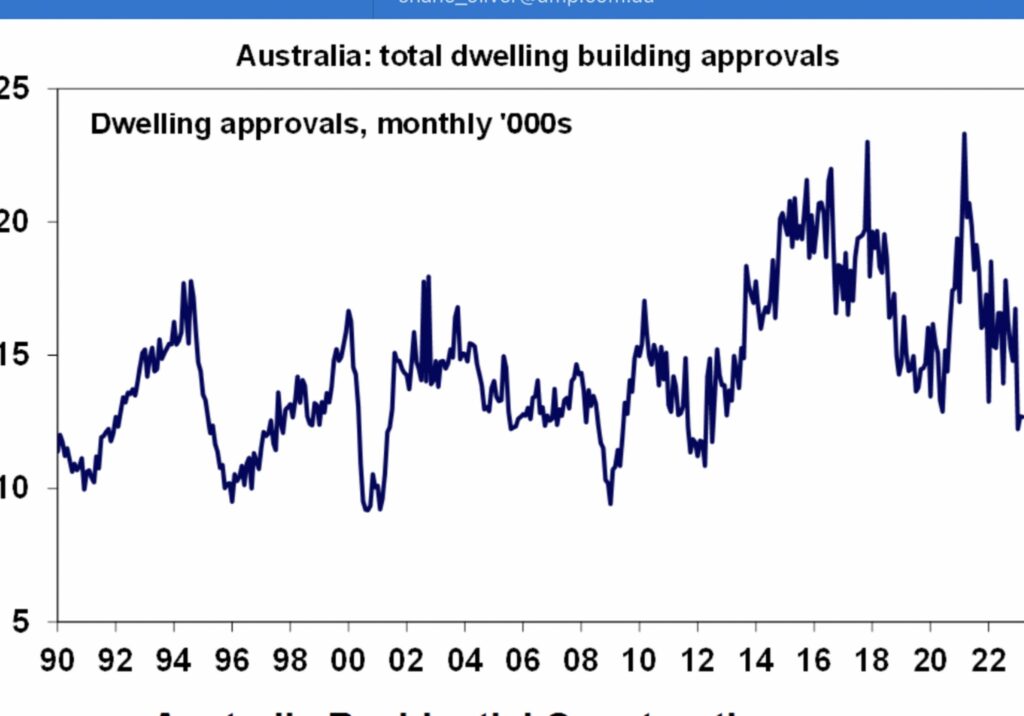

The undersupply of properties in Australia has been an ongoing issue, particularly in cities such as Sydney and Melbourne. This has been caused by a variety of factors, including a lack of available land for development, slow planning approvals, and a shortage of skilled tradespeople. The low number of house starts has only exacerbated this issue, as there are fewer new properties being built to meet the growing demand.

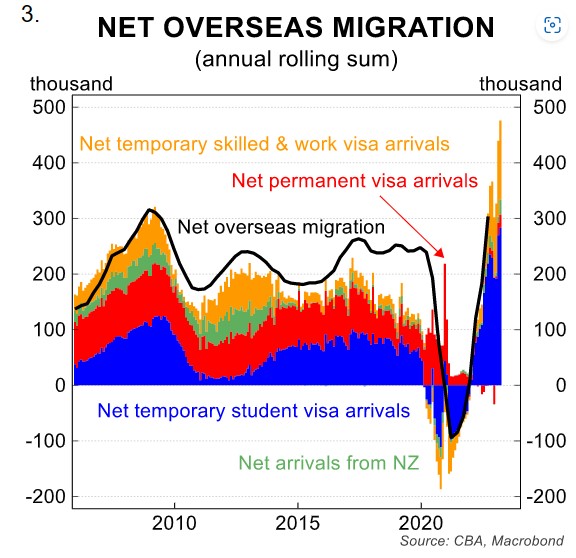

Furthermore, forecasts suggest that Australia will experience high levels of immigration in the coming years. This will place further pressure on an already strained property market. As more people move to Australia, demand for housing will increase, and property prices will rise even further. This is particularly true in cities with strong job markets and a high quality of life, such as Sydney and Melbourne.

Impact of Higher Interest Rates

The potential impact of higher interest rates on the Australian property market is a concern for many investors and home owners. As interest rates rise, so do the costs of servicing a mortgage. This can lead to financial hardship for home owners who may struggle to meet their repayments. This, in turn, could lead to more properties being put up for sale, increasing the supply and potentially causing property prices to fall.

However, the Reserve Bank of Australia (RBA) has indicated that any interest rate rises are likely to be gradual and will depend on a variety of economic factors, including inflation and unemployment. This means that any impact on the property market may be less severe than initially feared.

The debate over the Australian property market is complex, with a range of factors influencing it. The undersupply of properties due to low numbers of house starts, combined with forecast high immigration levels, may lead to further increases in property prices. However, the potential impact of higher interest rates on home owners could lead to financial hardship and more properties being put up for sale. It is important for investors and home owners to be aware of these factors and to take a long-term view of their investments. By understanding the market dynamics and potential risks, investors can make informed decisions and position themselves for success in any market environment.

Recent Comments