The stock market and bond market are two of the most important financial markets in the world. They both play a vital role in shaping the overall economic outlook of a country. However, there are times when these two markets may contradict each other, as we are seeing in Australia today. Despite the optimism of the share markets, the bond markets are predicting a recession in Australia. What does this contradiction means for investors.

The Optimism of the Share Markets

The share markets have been performing well in Australia this year. In fact, the benchmark S&P/ASX 200 has been close to record highs recently. This is a sign that investors are optimistic about the future of the Australian economy. Some of the factors contributing to this optimism include strong corporate earnings, government stimulus measures, and a rebound in global economic growth.

One of the main reasons for the share market’s optimism is the rebound in commodity prices. Australia is a major exporter of commodities such as iron ore, coal, and natural gas. The demand for these commodities has increased in recent months, leading to higher prices and increased profits for Australian companies.

The Pessimism of the Bond Markets

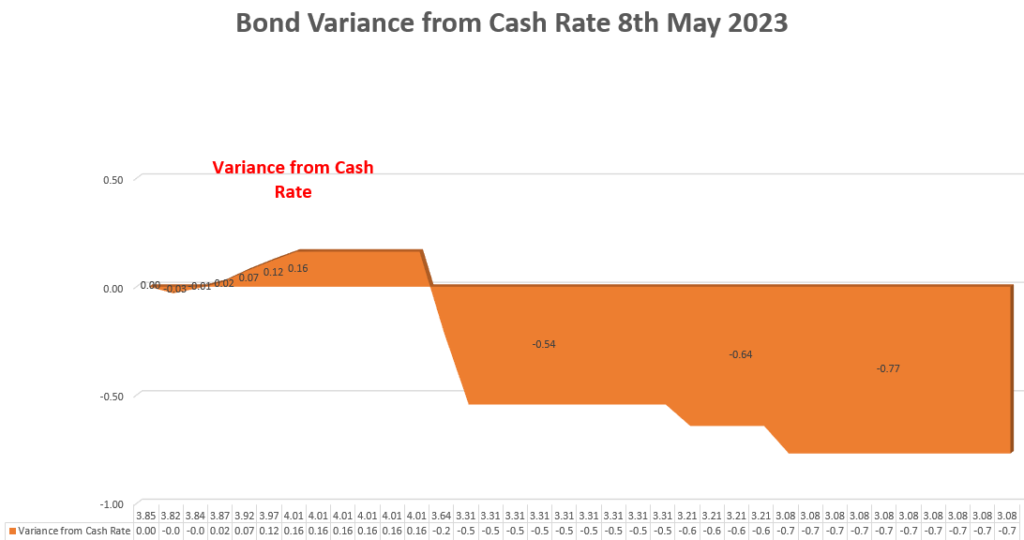

In contrast, the bond markets are predicting a recession in Australia. Bond yields have been falling recently, which indicates that investors are seeking safe havens for their money. When bond yields fall, it usually means that investors are worried about economic growth and inflation.

One of the main reasons for the bond market’s pessimism is the high levels of household debt in Australia and the possiblility of a recession. Many Australians have taken on large mortgages to buy expensive homes, and this has led to concerns about the sustainability of the housing market. If housing prices were to decline significantly, it could lead to a wave of defaults and a sharp contraction in economic activity.

Contradiction between the Share Markets and Bond Markets

The contradiction between the share markets and bond markets is not unusual. These two markets have different investment horizons and different risk profiles. The share market is forward-looking and tends to reflect investors’ expectations about future economic growth and corporate earnings. In contrast, the bond market is more focused on the present and is more concerned about the risk of default and inflation.

It is important for investors to be aware of this contradiction and to take a balanced approach to their investments. Diversification is key, as it allows investors to spread their risk across different asset classes. Investing in both shares and bonds can provide a hedge against market volatility and help investors achieve their long-term financial goals.

The contradiction between the optimism of the share markets and the pessimism of the bond markets is a sign that investors are uncertain about the future of the Australian economy. While the share market is performing well, the bond market is predicting a recession. It is important for investors to take a balanced approach to their investments and to be aware of the risks and opportunities in both the share and bond markets. By diversifying their portfolios and taking a long-term view, investors can position themselves for success in any market environment.

Recent Comments