Australian economists are now saying that we are at the top of the interest rate cycle, meaning that interest rates are unlikely to rise much further. This is causing a surge in activity in cities across eastern Australia, as buyers and sellers rush to take advantage of the current low rates.

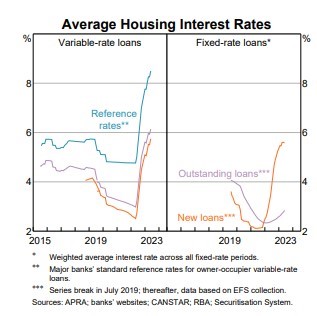

The Reserve Bank of Australia (RBA) has raised interest rates five times since May last year, in an effort to cool inflation. However, inflation is still running at a 20-year high of 5.1%, and the RBA is expected to raise rates one more time this year.

Despite this, economists believe that the RBA will not raise rates beyond 4.1%, which is the current cash rate. This is because they believe that the economy is already starting to slow down, and that further rate hikes would risk a recession.

The expectation that interest rates are at their peak is causing a surge in activity in cities across eastern Australia. In Sydney and Melbourne, the number of new listings has increased by 20% in the past month, and the number of sales has increased by 15%.

This is being driven by both buyers and sellers. Buyers are rushing to buy before interest rates rise any further, while sellers are taking advantage of the high prices to sell their homes.

The surge in activity is also being fueled by strong economic growth in eastern Australia. The unemployment rate in both Sydney and Melbourne is at a record low of 4%, and wages growth is picking up.

This combination of factors is creating a perfect storm for the property market in eastern Australia. With interest rates at their peak and the economy growing strongly, there is likely to be continued activity in the market for the next few months.

However, it is important to note that the situation could change if the economy slows down or if inflation falls. If this happens, the RBA may be forced to cut interest rates, which would cool the property market.

Recent Comments