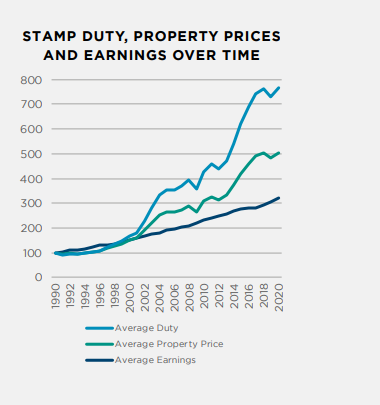

States and councils rely on a variety of taxes to fund their activities and provide public goods and services to its residents. However, the traditional reliance on property taxes, such as land tax and stamp duty, has come under scrutiny in recent years. Many experts argue that state governments and local councils should broaden their tax base and move away from a reliance on property taxes, to more equitable system. You just need to look at your property insurance to see the reliance on property taxes like the Emergency Services Levy in NSW which can add up to 26% to your premium (plus Stamp Duty and GST).

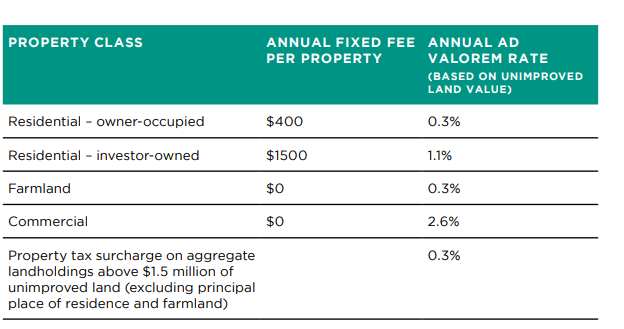

State governments have proposed a new land tax to replace stamp duty which only taxes the same people in a diferent way. One of the key reasons to broaden the tax base is to make the tax system fairer. Property taxes are generally based on the value of a person’s property, hoping it is a reflection of their ability to pay. However, this approach does not take into account other factors that may impact a person’s ability to pay taxes, such as their income or other assets. By expanding the tax base to include other types of taxes, such as residents taxes, state governments and local councils could ensure that the tax burden is distributed more equitably among all residents.

Another reason to broaden the tax base is to create a more stable source of revenue for government activities. Property values can be highly volatile, and fluctuations in the property market can have a significant impact on the revenue generated by property taxes. By diversifying the tax base to include other types of taxes, state governments and local councils can create a more stable revenue stream that is less vulnerable to fluctuations in the economy.

In addition to creating a fairer and more stable source of revenue, broadening the tax base can also help to incentivize desirable behavior. Taxes can be used to encourage residents to adopt more sustainable practices, such as using public transportation or reducing their energy consumption. By creating incentives for residents to engage in these behaviors, state governments and local councils can help to address some of the environmental challenges facing the country.

Finally, broadening the tax base can help to ensure that government activities are funded in a sustainable manner. As the population of Australia continues to grow and age, the demand for public goods and services will increase. By expanding the tax base to include other types of taxes, state governments and local councils can ensure that they have the resources they need to meet this growing demand.

While there may be concerns about broadening the tax base, such as the potential for some types of taxes to be less popular among residents than property taxes, these concerns can be addressed by carefully designing the tax system to ensure that it is fair and transparent. Additionally, broadening the tax base may require significant changes to the tax system, which could be complex and time-consuming to implement. However, the potential benefits of a more equitable, stable, and sustainable tax system make this effort worthwhile.

In conclusion, state governments and local councils in Australia should seriously consider broadening their revenue base and moving away from a reliance on property taxes. By creating a fairer and more stable source of revenue, incentivizing desirable behavior, and ensuring that government activities are funded sustainably, this approach to taxation can help to ensure a brighter and more prosperous future for Australia and its citizens.

Doug Daniell – Guest Contributor

Recent Comments