Martin North| Digital Finance Analytics| 8 March 2018

The ABS released their latest data on the Assets and Liabilities of Australian Securitisers.

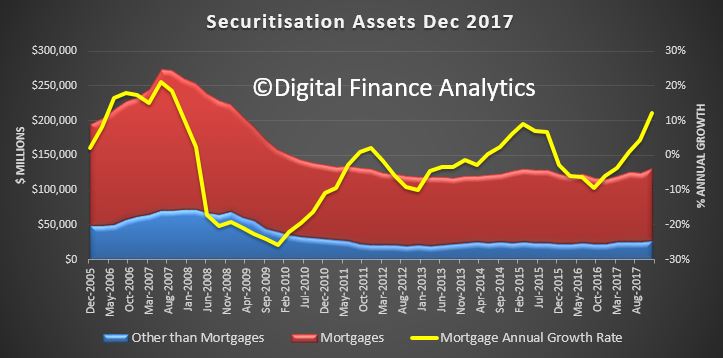

At 31 December 2017, total assets of Australian securitisers were $132.5b, up $7.3b (5.9%) on 30 September 2017. During the December quarter 2017, the rise in total assets was primarily due to an increase in residential mortgage assets (up $6.0b, 6.0%) and by an increase in other loans assets (up $0.9b, 6.1%).

You can see the annual growth rates accelerating towards 13%. The non-banks are loosely being supervised by APRA (under their new powers), but are much freer to lend compared with ADI’s. A significant proportion of business will be investment loans.

You can see the annual growth rates accelerating towards 13%. The non-banks are loosely being supervised by APRA (under their new powers), but are much freer to lend compared with ADI’s. A significant proportion of business will be investment loans.

This is explained by a rise in securitisation from both the non-bank sector, which is going gangbusters at the moment, and also some mainstream lenders returning the the securitised funding channels, as costs have fallen.

There is also a shift towards longer term funding, and a growth is securitised assets held by Australian investors. Asset backed securities issued overseas as a proportion of total liabilities decreased to 2.6%.

At 31 December 2017, total liabilities of Australian securitisers were $132.5b, up $7.3b (5.9%) on 30 September 2017. The increase in total liabilities was primarily due to an increase in long term asset backed securities issued in Australia (up $8.6b, 8.0%). This was offset by a notable decrease in short term asset backed securities issued in Australia (down $1.1b, 22.8%), and loans and placements (down $0.3b, 4.1%).

At 31 December 2017, asset backed securities issued in Australia as a proportion of total liabilities increased to 89.8%, up 0.7 percentage points on the September quarter 2017 proportion of 89.1%. Asset backed securities issued overseas as a proportion of total liabilities decreased to 2.6%, down 0.1 percentage points on the September quarter 2017 proportion of 2.7%.

{rokcomments}

Recent Comments